geothermal tax credit 2021 irs

Like that other credit the amount you can get back is still 30 with a decline until the tax credit expires after 2021. January 4 2021 Helping provide incentives for homeowners to make energy-efficiency home improvements the federal government and some local utility companies offer tax credits as a way to offset the costs of these repairs or changes and theyve just extended their timeline.

Renewable Energy Production Tax Credits Irs Releases 2020 Inflation Factor Reference Prices Alerts Barnes Thornburg

Great news the Federal Investment Tax Credit ITC for geothermal has been extended through 2023.

. 30 for systems placed in service by 12312019. The tax credit also retroactively applies to new air conditioners installed in the 2018-2020 tax year. Excise Tax on Certain Transfers of Qualifying Geothermal or Mineral Interests 1213 03132019 Form 8923.

This includes the solar energy tax credit. The Energy Policy Act of 1992 PL. IRS e-file Signature Authorization for Form 1120-F 2021 11122021 Form 8879-F.

Certainly makes the choice to build green a lot more appealing. What Is The 2021 Geothermal Tax Credit. Electricity from wind closed-loop biomass and geothermal resources receive as much as 25 centskWh.

The taxpayer spends 12000 to install a new geothermal heat pump property in 2021. It can only reduce or eliminate your liability how much money you owe to the IRS. Its gone through cycles of expiration and extension over the last 15 years most recently expiring at the end of 2016 and undergoing reinstatement in 2018.

The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for the most savings. In other words you get the benefit of a great heating and cooling system and the IRS picks up 30 of the bill. Beside this is there a tax credit for air conditioners in 2019.

Renewable energy tax credits for fuel cells small wind turbines and geothermal heat. You will add up your various energy credits on IRS Form 5965. The ITC extension will allow homeowners who install a geothermal heat pump to deduct 26 of the cost of the system from their federal income taxes.

However after 2019 the credit value will be steadily reduced so its worth installing these energy-efficient upgrades now. Geothermal Investment Tax Credit Extended Through 2023. If your tax burden in 2020 is less than the full amount of your credit you can carry over the.

In December 2020 the tax credit for geothermal heat pump installations was extended through 2023. However with the Consolidated Appropriations Act of 2021 geothermal systems wind turbines and fuel cells are on a gradual step-down incentive. Federal Geothermal Tax Credits have recently been amended thus you may have 26 Federal Geothermal Tax Credits to get for systems installed by Jan.

For qualified fuel cell property see Lines 7a and 7b later. You can use IRS form 5695 to claim your residential energy credit. The renewable energy tax credit is for solar geothermal and wind energy installments and improvements.

Renewable Energy Tax Credits. The Nonbusiness Energy Property Credit is only available on primary residences. Many tax credits were extended with many applying to green upgrades on residential properties.

What qualifies for geothermal tax credit. 102-486 the only tax credits remaining from the Energy Tax Act of 1978 PL. With this energy tax credit you can deduct 30 of the cost of installing a geothermal system right off your taxes.

If you made any such improvements you could continue to claim these energy tax credits through IRS Form 5695. Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems. Geothermal systems do qualify for tax credits.

The 2021 geothermal tax credit has been around in various forms since 2005. New constructions and rental properties dont. The tax credit originally expired December 31 2017 If you have not previously claimed the Non.

Tax deductions for energy efficient commercial buildings allowed under Section 179D of the Internal Revenue Code were made permanent under the Consolidated Appropriations Act of 2021. Through this legislation geothermal heat pumps were added to the definition of energy property under section 48a of the Internal Revenue Code which provides a 10 investment tax credit for spending on property the construction of which begins prior to 112022. In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the.

November 21 2021 Tax Credits. The tax credits for solar and geothermal as did the Tax Extension Act of 1991 PL. The Nonbusiness Energy Property Credit.

The geothermal heat pump is replacing a prior geothermal heat pump installed in 1995. You may be able to take a credit of 26 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property and fuel cell property. The PTC provides a corporate tax credit of 13 centskWh for electricity generated from landfill gas LFG open-loop biomass municipal solid waste resources qualified hydroelectric and marine and hydrokinetic 150 kW or larger.

The Geothermal Tax Credit however is a non-refundable personal tax credit. You can even keep doing this as long as the tax credit is active. The tax credits for residential renewable energy products are now available through December 31 2023.

You should also use Form 5695 to take any residential energy efficient property credit carryforward from 2017 or to carry the unused portion of the credit to 2019 IRS. If your tax burden in 2021 is less than the full amount of your credit you can carry over the remainder when filing your taxes in 2022. 95-618 were the newly permanent 10 solar and geothermal credits.

Premium Tax Credit PTC 2021 12132021 Inst 8960. This means that certain qualifying air conditioners and heat pumps installed through December 31 2021 are eligible for a 300 tax credit. DEPRECIATION OF ENERGY PROPERTY.

12000 x 26 3120 Qualified geothermal heat pump property expenditures include replacement units as long as they meet the eligibility requirements. The Geothermal Tax Credit can offset regular income taxes and even alternative minimum taxes. All tax credits on these products are eligible until December 31 st 2021.

The Bipartisan Budget Act provided a huge relief to taxpayers across the nation. If your system was installed before December 31 2019 the tax credit is 30 26 if installed by January 1 2023 and 22 if installed by January 1 2024. 102-486 made the credits for solar and geothermal permanent.

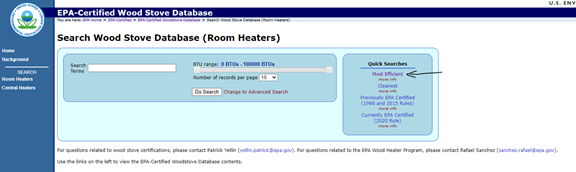

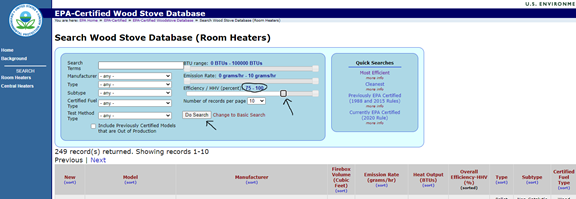

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

Irs Form 5695 Lines 1 4 Irs Forms Irs Tax Credits

The 2021 Federal 26 Tax Credit On Wood Pellet Stoves We Love Fire

Steps To Complete Irs Form 5695 Lovetoknow

Irs Releases 2021 Section 45 Production Tax Credit Amounts Mayer Brown Tax Equity Times Jdsupra

300 Federal Tax Credits For Air Conditioners And Heat Pumps Symbiont Air Conditioning

The Federal Geothermal Tax Credit Your Questions Answered

The 2021 Federal 26 Tax Credit On Wood Pellet Stoves We Love Fire

How To Claim The Federal Solar Investment Tax Credit Solar Sam

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Irs Schedule 3 Find 5 Big Tax Breaks Here The Motley Fool

The Alliance For Green Heat Federal Tax Incentives For Wood And Pellet Stoves Sustainable Local And Affordable Heating

Tax Breaks I May Not Know About

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

There S Still Some Juice Left In The Residential Energy Tax Credit For 2014 Returns Cpa Practice Advisor